Countries where MPESA has been expanded to

M-PESA was launched in Kenya in March 2007.

It has made life easier for traders and customers alike

In Summary

Audio By Vocalize

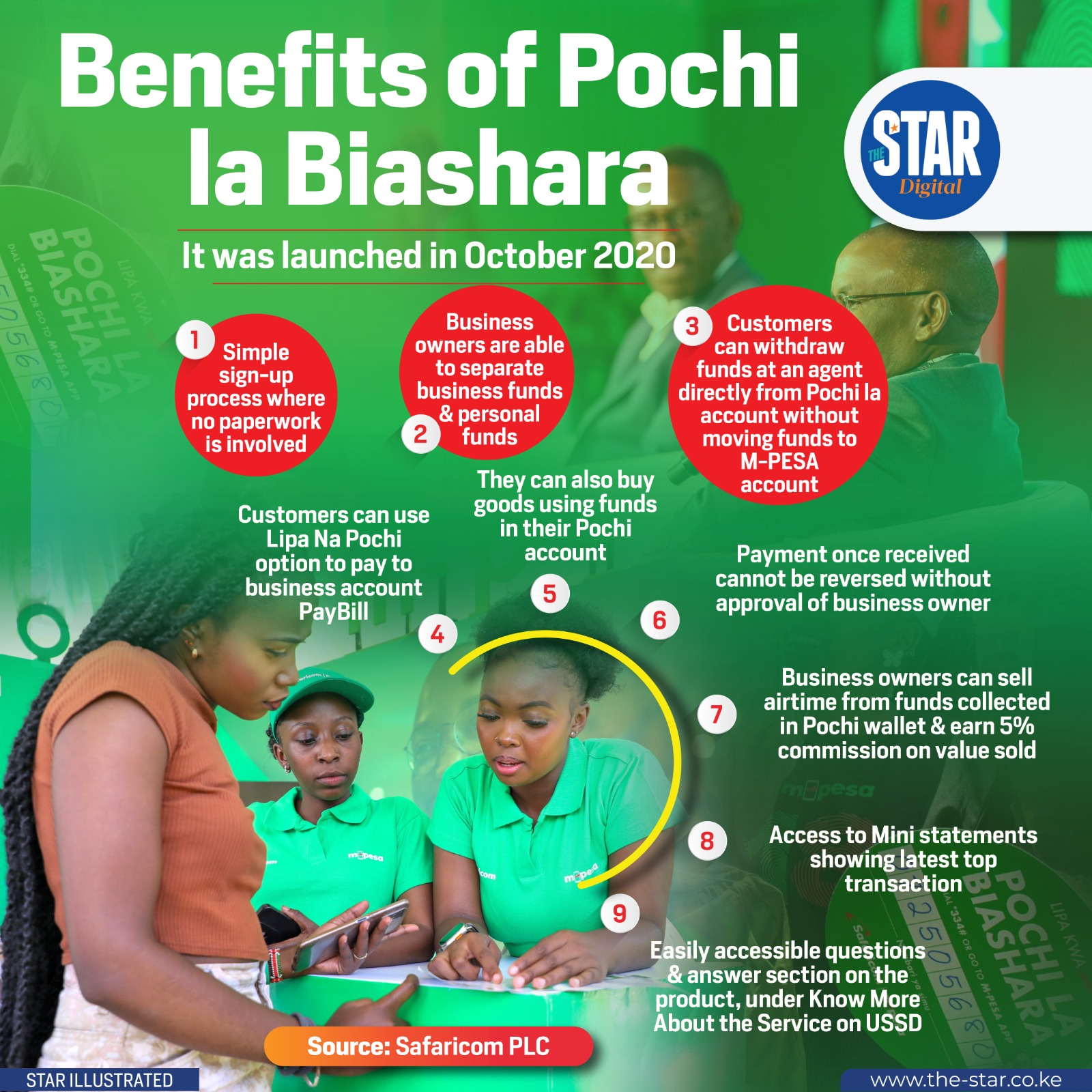

If there is one thing eggs and smokies seller Oliver Wafula loves about Safaricom, it is the Pochi la Biashara option under Lipa na M-Pesa.

Wafula, who plies his trade at School Lane in Westlands, Nairobi, was long troubled by unscrupulous customers defrauding him of his hard-earned money.

“Pochi has really helped me due to the inability to reverse funds once the customers pay for the products, and that is something that I really like about the service,” he says.

Njambi, a customer who just bought a cocktail fruit juice using Pochi la Biashara, commends the Lipa na Mpesa mobile service for aiding her in her day-to-day basis.

“I frequently use the options of Pochi, till number and buy goods to buy products and pay fare,” she says.

“When I want to pay for my house rent and school fees, I utilise the paybill number under Lipa na M-Pesa.”

Kelvin, a vendor in Westlands, commends the cost-friendly nature of Lipa na M-Pesa through Pochi la Biashara. He adds that the system is inclusive as it ensures that all stakeholders can access and afford it.

“I like using Pochi because it is relatively cheap, which enables my clients to access it easily. It has enabled my business to run smoothly,” he says.

James, who makes a living from selling chips in Westlands, credits the mobile service provider for enabling a healthy environment for his business.

“Before Safaricom introduced Lipa na M-Pesa, I had health concerns attributed to the constant handling of cash,” he says.

“That has since changed thanks to the service, as we no longer have to come into contact with cash.”

Muthoni, a content creator, was once briefly stranded when she tried to buy some food in a supermarket using a bank card. “My card was not working and I had to think of a quick option, where I opted to use paybill to pay,” she said.

“Luckily I had some money in my M-Pesa, which enabled me to make the transaction, which could have left me stranded.”

GAME CHANGER

These experiences reflect a seismic change in transactions that has earned Kenya global renown. For many decades, businesses in Kenya grappled with the inefficiencies of cash.

Long queues, security risks and the constant struggle of handling change. Customers had to carry physical money, businesses struggled with handling change, and reconciling daily sales was a manual headache.

Fraud and theft were constant threats, and long queues at banks made transactions slow and inefficient. But in 2012, Lipa Na M-Pesa changed everything.

Today, with more than 200,000 businesses on board, this revolutionary service has empowered entrepreneurs with secure, cashless payments, higher transaction limits and seamless integration into their daily operations.

Safaricom CEO Peter Ndegwa says mobile phones have today become the most preferred alternative to cash, and its popularity only continues to grow.

“More than ever, an increasing number of businesses are discovering the numerous advantages of cashless payments, resulting in high growth for Lipa Na M-Pesa,” he said during celebrations to mark M-Pesa’s 18th birthday.

“We continue to add more features and tools with the goal of empowering our business customers to grow and better manage their businesses.”

The story of Lipa Na M-Pesa is deeply intertwined with the evolution of M-Pesa itself. What began as a simple mobile money transfer service back in 2007 has blossomed into a powerful financial ecosystem, transforming how businesses operate and transact.

For Kenyans, including the diaspora, and more so small businesses, the impact has been even more profound.

Entrepreneurs who previously relied on informal cash transactions can now track sales, manage cash flow and even access credit through integrated financial services.

Before its introduction, Ndegwa said, millions of Kenyans were excluded from formal financial systems and even lacked basic financial services as loans, savings and payment platforms.

“M-Pesa changed all that,” he said. “It brought financial services to the fingertips of millions of Kenyans, enabling them to send money and receive money, pay bills and access credit at ease,” he says.

It was not just a technological invention but also a social revolution that has empowered women, he added.

HOW IT STARTED

Ndegwa said the success of the M-Pesa is a testimony to the power of technology.

“We listened to our customers, understood their needs and developed a solution that is simple, accessible and affordable. We built a platform that will not just technologically advance but also be deeply rooted in the cultural context of Kenya.”

He said back when he was working abroad, the platform helped him a lot in sending money back home in Kenya.

Safaricom founder Michael Joseph recounted the journey of M-Pesa, saying it cost them a lot of money to start, and they are proud it has transformed and changed many lives. At one point, the idea nearly ‘died’, but he soldiered on.

“Our Vodafone shareholders came in and said we were wasting time and money, that this was a stupid idea. But I said I am going to do it anyway,” Joseph said.

He said he never created the platform as a money-making venture but one intended at providing solutions for Kenyans.

“It took all the loyalty money we had. We took that money into M-Pesa, so it is a loyalty product,” Joseph said. “All we wanted to do is to create a product that our loyal customers would love and continue to be with us.”

The first business plan was to attract 350,000 customers in one year. Initially met with skepticism, its ease of use and convenience quickly won over users.

A month after the launch, it had 19,671 mobile active users. In November of that year, the numbers had ballooned to an unprecedented 1,041,522 active M-Pesa users.

Within three years of its launch, M-Pesa had more than 10 million users in Kenya, revolutionising how money was sent, received and stored.

By 2010, the service had expanded to Tanzania and later to other African countries, including Ghana, Egypt, Mozambique and the Democratic Republic of Congo.

Currently, it allows customers across seven African markets to instantly and securely send money, pay bills, make in-store payments and access financial services as loans and overdraft facilities right at their fingertips.

The company also manages more than 300,000 agents across the country, with agent commissions making up the bulk of expenses.

The idea to establish M-Pesa was conceived in the early 2000s, a time when mobile phone use in Kenya was on the rise, yet formal banking services remained out of reach for much of the population.

With only about 26 per cent of Kenyans having access to formal banking, the majority relied on informal and often unreliable methods to send money.

People had to trust matatu drivers, friends or family members to deliver funds, since traditional banking methods like bank transfers or postal orders took days to process.

The origin of M-Pesa is traced back to a pilot project funded by Vodafone Group and the UK’s Department for International Development (DFID), both of which were eager to find innovative solutions for the unbanked.

Initially mooted in 2003 by Nick Hughes, the head of social enterprise at Vodafone, the idea was to create a mobile-based microfinance repayment system.

Hughes reached out to various partners, including banks, microfinance institutions and tech service providers in Kenya and Tanzania.

In 2005, with the addition of Susie Lonie, an expert in mobile commerce, M-Pesa was finally ready for its pilot launch.

EARLY DAYS

Safaricom, M-Pesa’s parent company then embarked on a recruitment spree.

It identified airtime dealers for this and in October 2005, eight agent stores and later 15 were given phones with an M-Pesa menu.

However, early trials conducted through a prototype in Thika revealed that users were using the platform for sending money to family and friends even as they made loan repayments. This insight led to a strategic pivot, transforming M-Pesa into a mobile money transfer service that allowed users to send and receive money through their mobile phones.

“What we found in practice was that people who received the loans were sending the money to other people hundreds of miles away,” Joseph said when M-Pesa was turning 10.

“In hindsight, we had inadvertently identified one of Kenya’s biggest financial challenges.”

The rush by businesses in taking up the service has also been to meet the growing uptake of Lipa Na M-Pesa among Kenyans, with customers using the service increasing by 1 million since January 2020 to more than 6 million today.

The retail sector leads in business usage of the service, followed by hospitality (hotels, restaurants and bars and catering), then general trade and distributors.

With a growing number of small businesses on the service, Safaricom has recently unveiled several innovations that focus on them.

These include the Lipa Na M-Pesa Business App, which for the first time provides many of these businesses with detailed reporting tools and a dashboard to track their cash flow.

The app has been downloaded by more than 90,000 businesses since its launch two months ago.

Safaricom also launched the Transacting Till, where small businesses on Lipa Na M-Pesa can make payments through Lipa Na M-Pesa, send money to M-Pesa customers and withdraw cash from agents.

Other key innovations through the years include the M-Pesa Daraja Application Programming Interface (APIs), which empowers any business or developer to build their applications on top of M-Pesa.

In March 2007, Safaricom marked five years of the service by permanently slashing Lipa Na M-Pesa Tariffs to a maximum of 0.5 per cent of the transaction value.

As part of measures to assist businesses better cope with the Covid-19 pandemic, Safaricom has waived all merchant transaction fees for all Lipa Na M-Pesa transactions of Sh1,000 and below.

Safaricom Board chairperson Adil Khawaja on his part said the journey of M-Pesa was more than just launching the product but re-imagining financial services and taking bold risks. He said the success of M-Pesa is attributed to great strides by various stakeholders.

“Success is never the result of one person’s vision’s alone but rather the combined efforts of committed individuals, institutions and partners who believe in a dream before it becomes a reality,” he said during the event.

M-PESA was launched in Kenya in March 2007.

M-PESA is celebrating 18 years. It was launched in Kenya on March 6, 2007.