Nakuru County Governor Susan Kihika has launched Wezesha

Funds, a Sh100 million financial empowerment initiative targeting small

businesses and cooperatives.

The program, unveiled at the Agricultural Training Centre

(ATC) in Soilo, features the Nakuru County Enterprise Fund and the Cooperative

Revolving Development Fund, aimed at easing access to affordable credit for

MSMEs and cooperatives.

The Enterprise Fund offers loans between Sh50,000 and

Sh200,000 to registered groups at 8 percent annual interest, while the

Cooperative Fund provides Sh200,000 to Sh5 million loans at the same rate.

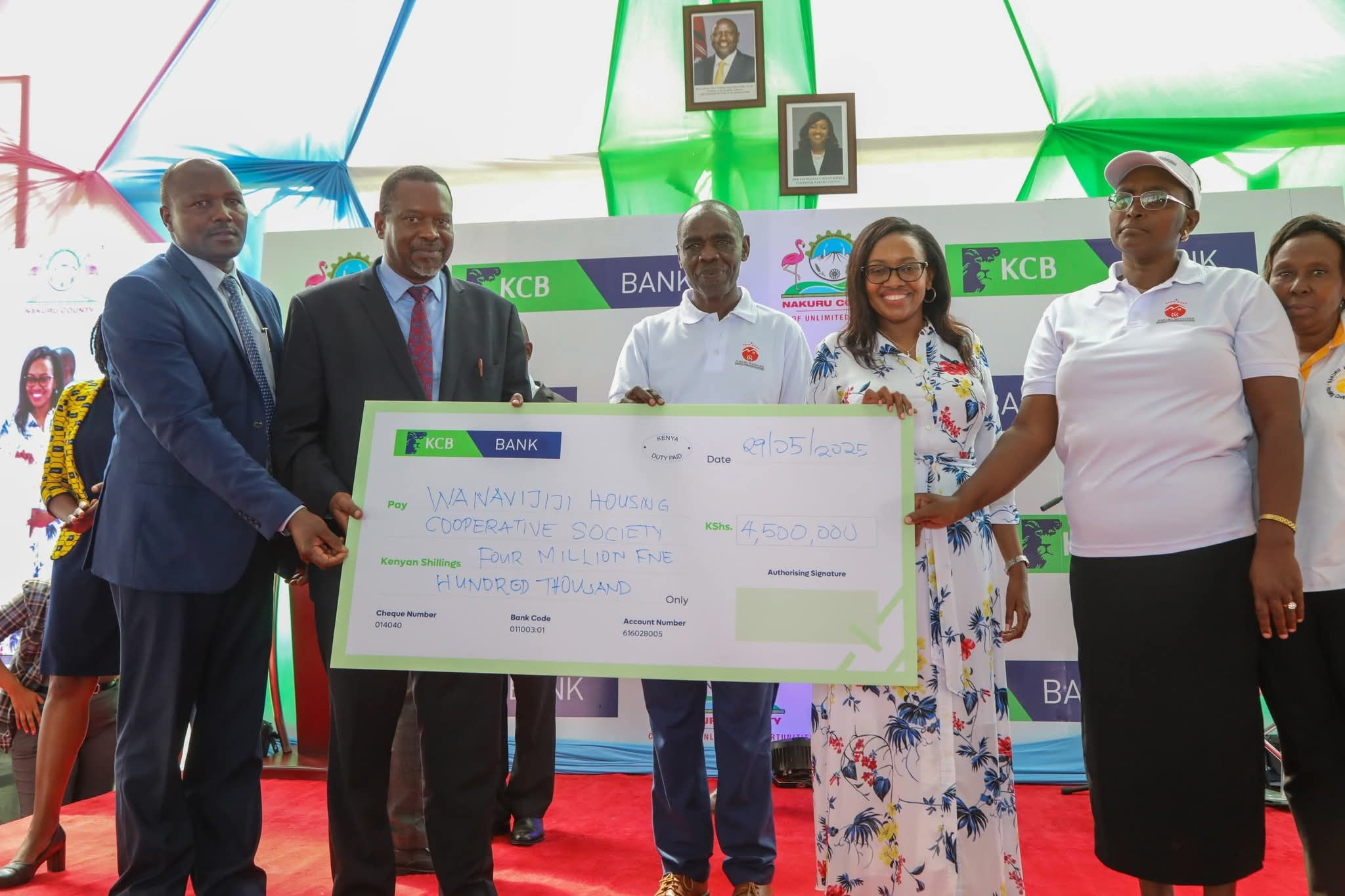

“So far, six cooperatives have qualified for Sh21 million, while 95 groups have secured Sh16 million,” Kihika said Friday.

“To ensure transparency, the County Government has

partnered with Kenya Commercial Bank (KCB) for loan appraisal and disbursement.”

Governor Kihika urged traders, boda boda riders, CHPs,

farmers, women, and youth to join Saccos or groups to access the funds.

She noted that 2,762 out of 3,300 CHPs had already

registered with the Nakuru CHP Sacco.

She also encouraged them to register for the Social Health

Authority (SHA).

“SHA works. Pay for

SHA and we’ll ensure you’re taken good care of at the hospitals.” The Governor

reminded beneficiaries that the money is a loan and must be repaid in full to

allow others to benefit.

She welcomed partnerships with donors, financial institutions, and the private sector to grow the fund through grants and co-financing.

With this launch, Nakuru joins other counties advancing

affordable credit to drive grassroots economic growth.

KCB General Manager David Nyamu encouraged responsible

borrowing, promising to increase loan limits up to five times—and eventually

ten times—for consistent borrowers.

He said Nakuru has the potential to become a leading

investment hub