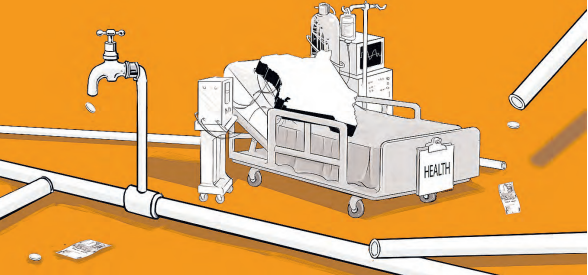

In business, there’s a golden rule: cash is king. A company can have strong revenues on paper, but if cash isn’t flowing in time, it will collapse.

The same principle applies to hospitals. Yet, in Kenya, the government continues to strangle health facilities financially— delaying billions in payments while expecting them to operate seamlessly.

The result is a healthcare system on the brink of collapse, with hospitals shutting down services, laying off staff and turning away patients who should, in theory, be covered by government insurance.

Faith-based and private hospitals, which serve millions, are currently owed over Sh10 billion by the defunct National Health Insurance Fund, the Social Health Authority and other agencies.

These delayed payments have crippled operations, making it impossible for hospitals to pay staff, procure essential medical supplies or even keep life-saving equipment running.

Many hospitals have reached their breaking point, suspending services under SHA and demanding cash payments from patients who can barely afford them.

Across Kenya, hospitals are forced to provide services on credit, waiting months or even years for reimbursement.

The consequences of this financial strangulation are most devastating for patients. What is the point of universal healthcare if hospitals cannot afford to keep their doors open?

But there’s another layer to this crisis—fraudulent claims by some hospitals.

NHIF and now SHA have raised concerns over exaggerated or even fictitious claims lodged by certain providers, prompting stricter verification processes.

The dishonesty of a few is causing massive pain for everyone else. In response to fraud, the government has implemented longer and more complicated claim verification processes, some involving up to 10 approval stages and additional checks for payments above Sh10 million, introducing delays of up to five months.

While these measures may be necessary to prevent abuse, they should not be an excuse to delay all payments indefinitely.

Hospitals that have followed due process should not be punished for the actions of a dishonest minority. Meanwhile, healthcare workers are beginning to crack under the pressure.

Salaries are delayed, morale is at an all-time low and the growing frustration has led to threats of mass strikes. Civil servants insured under SHA are being rejected at hospitals that can no longer afford to provide credit-based services.

At the same time, Kenyan doctors and nurses are leaving the country in record numbers, recruited by better-paying health systems in the UK, US and Canada.

If the government fails to act, Kenya will not only lose its hospitals—it will lose its health workforce too.

The solution to this crisis is simple: pay hospitals what they are owed. Do it now. The government must immediately release all pending NHIF/ SHA payments, clearing the backlog within 60 days.

Going forward, NHIF and SHA must be required to process and disburse payments within 30 days—just like any other business contract.

There is no reason why hospitals should be expected to wait indefinitely while struggling to stay afloat. The bureaucratic red tape must be cut—SHA’s approval system needs urgent reform, and regional offices must be empowered to resolve payment disputes locally, instead of everything being centralised in Nairobi.

Beyond government action, hospitals themselves must rethink their dependence on SHA. Diversifying revenue streams through direct-pay models, employer-sponsored healthcare, and private insurance partnerships will help reduce exposure to the erratic government system.

Faith-based and private hospitals should also consider taking a united stand—if NHIF and SHA do not pay, providers should not accept new patients under these schemes. Kenya’s push for universal healthcare is meaningless without financial sustainability.

No business can survive on IOUs. No hospital should be expected to. The lifeblood of any healthcare system is cash flow, and right now, Kenya’s hospitals are being bled dry.

If this crisis is not addressed urgently, the healthcare system will collapse—not due to lack of infrastructure, but due to a lack of financial liquidity.

The government must decide: either pay what is owed or watch the system break down completely. If I was a conspiracy theorist, I might say this is the plan – but lets not go into deep dark holes for which we have no proof.

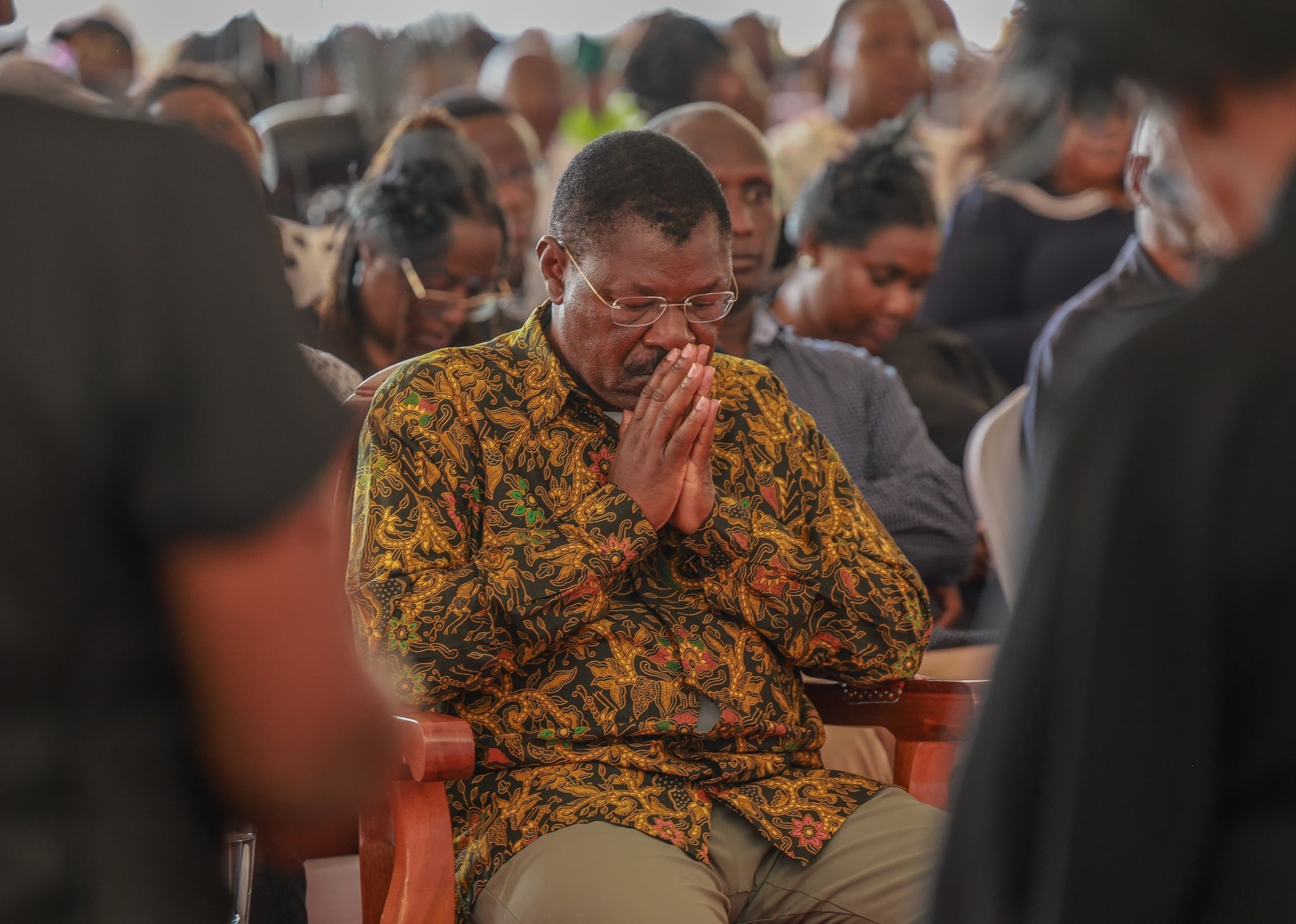

Nicholas Okumu is a Surgeon, writer and advocate

of healthcare reform and leadership in Africa.