M-PESA: Game changer in Ethiopia fintech market

In Ethiopia, M-Pesa is solving the cash dependency problem.

It has changed their fortunes and helped them educate their children

In Summary

Audio By Vocalize

In early 2008, a young man knocked on Nancy Muthoni’s door, seeking a job opportunity. Little did Muthoni know that this encounter would mark the beginning of a transformative chapter in her life.

At the time, Muthoni, a teacher, had no job to offer him. Instead, she challenged him to come up with a viable business idea, one she could fund.

The young man took on the task, did his research and discovered that M-Pesa, a newly introduced mobile payment system, was gaining traction in Kenya.

Safaricom had launched M-Pesa on March 6, 2007.

“He came back and asked, ‘Can we start an M-Pesa business?’ Of course, I had no idea how it worked, so I went to Safaricom, where they explained the process of becoming an agent,” Muthoni recalls.

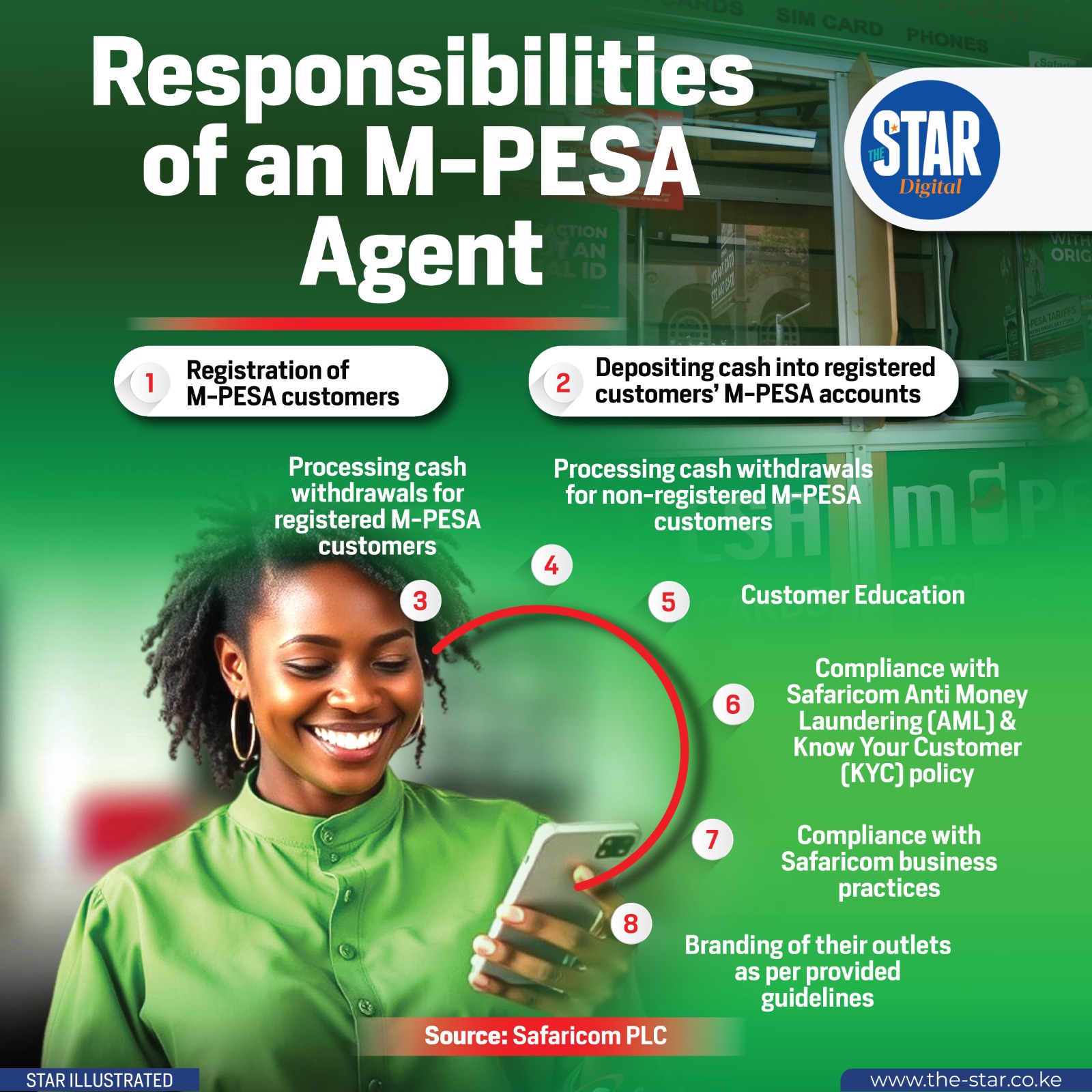

An M-Pesa agent is a registered individual or business that facilitates M-Pesa transactions, such as cash deposits and withdrawals, for customers, acting as a bridge between the mobile money platform and its users.

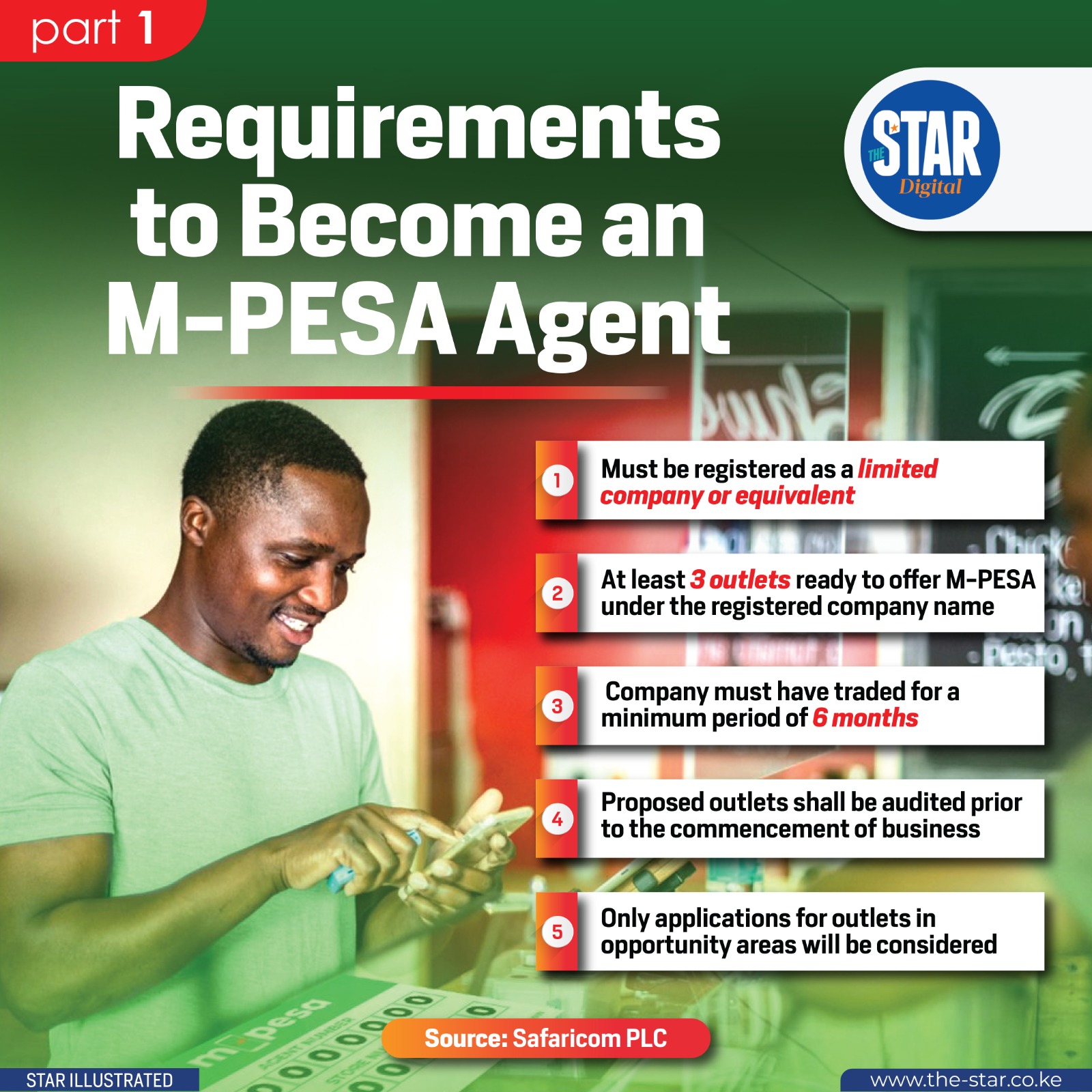

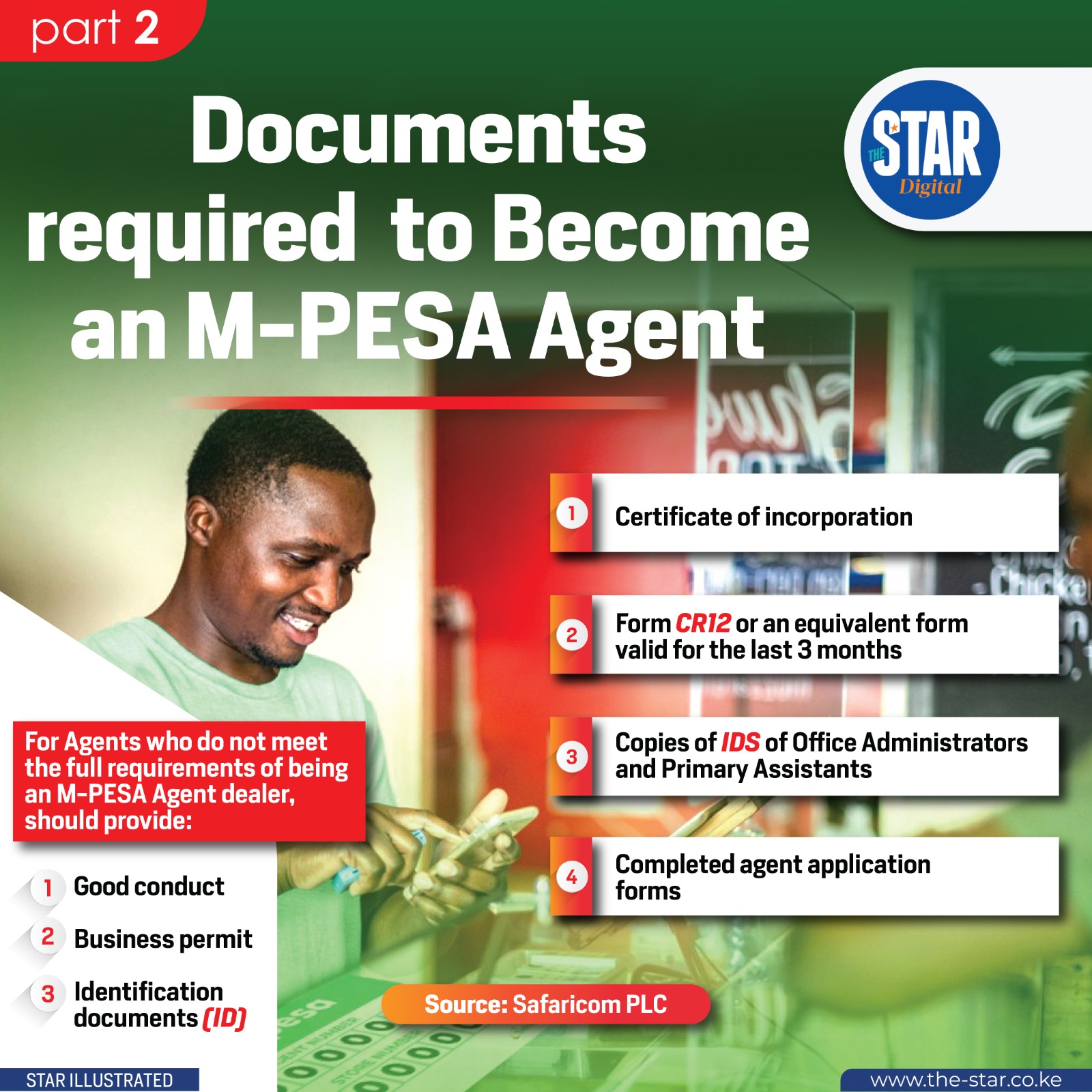

Determined to seize the opportunity, she used her Sh300,000 capital to open M-Pesa shops in three different provinces: Nairobi, Rift Valley and Central Kenya

This is because one of the requirements was for one to operate in three different regions.

She admits that this was challenging but she had to push it. “It wasn’t too difficult for us,” she says.

“We travelled extensively, scouting for ideal locations, setting up shops and applying for M-Pesa lines to get the business running.”

A few months into the business, she made a bold decision. She quit her teaching her job to focus entirely on her new venture of being an agent.

Since then, her business has had a tremendous impact on her life, including educating her children, with one even studying abroad and now working as a registered nurse.

She has also bought a plot and built a house on it.

“I was able to take one of my kids to Australia, and all those other businesses I was doing could not enable me to pay the amount of money I paid for him to study there,” she said.

“I have also bought land and built a house through the business. As a teacher, I would have not achieved all these.”

Eighteen years later, Muthoni believes the M-Pesa business has positively impacted countless lives and significantly contributed to Kenya’s economy. “As a businesswoman, M-Pesa has had a huge impact on my life.

I was once employed but that changed. The same goes for many other agents,” she says.

Additionally, M-Pesa has boosted the economy because most Kenyans have embraced it, she says. Today, hundreds of people work under Muthoni as sub-agents in various parts of the country, creating employment opportunities for many.

“As an agent, I own outlets not just in my locality but across the country. This has positively impacted many people working under me, and other agents now have a source of livelihood,” she says.

SIMILAR TESTIMONY

Dr Esther Muchemi has a similarly inspiring story. She left a prestigious career in auditing to chase a bigger dream, one that would establish her as a trailblazing entrepreneur.

“I left formal employment in pursuit of my dreams and greatness, founding Esther Muchemi and Company Auditors,” she writes in her biography.

But she didn’t stop there. In 2000, she launched Samchi Telecommunications Ltd, a venture that would evolve into a thriving conglomerate.

As one of the pioneer M-Pesa dealers when the mobile money revolution hit Kenya, Muchemi turned a small shop in Nairobi’s CBD into a business empire, creating jobs for hundreds and inspiring many.

“I was doing well in my shop, selling typewriters and fax machines. I was also a dealer for another telecommunications company and had many customers,” Muchemi recalls.

At the time, mobile telephony was still new, with Safaricom’s subscriber base standing at fewer than 500,000 users. It was on a typical day at her shop in Nairobi CBD that Muchemi’s lady luck came knocking.

“I was just seated in my shop when a man whom I came to learn later was Hussein Mohamed approached me and asked me to become an exclusive dealer for Safaricom. After consulting my staff, my journey with Safaricom started,” she said.

Hussein Mohamed at the time worked as a marketing official for Safaricom.

“When the telecommunications sector was starting in the early 2000s, being a dealer entailed selling scratch cards and SIM cards. A SIM card cost Sh2,500 and the least airtime was worth Sh500,” Muchemi said.

A Safaricom dealer is a business partner who sells Safaricom products and services, such as data, mobile devices and airtime on behalf of the telco.

They are part of Safaricom’s business network, and they play a crucial role in distributing the company’s offerings. As a trained auditor and salaried partner in one of the top audit firms, Muchemi was no stranger to the world of business.

Safaricom was a new player in the market, and the challenges of securing customers and building a distribution network were daunting.

Muchemi, however, was not deterred. With limited resources and a single shop, she adopted an innovative approach. Instead of waiting for customers to come to her, she went out to them, recruiting more than 60 salespeople to help distribute Safaricom’s products.

“We didn’t have much to start with. We didn’t even have a big budget for marketing,” Muchemi said.

“But I believed in the product, and I knew that if we worked hard enough, we could build a customer base.”

GROWTH AND DIVERSIFICATION

Her dedication and hard work paid off when she became one of the top-performing Safaricom dealers.

“My success as a dealer wasn’t just about selling a product,” Muchemi said.

“It was about understanding the market, finding innovative ways to reach customers and providing excellent service. Safaricom trusted me with their brand, and I didn’t take that lightly.”

She didn’t just stop at selling airtime and mobile lines, she diversified her business, expanding into retail and wholesale operations. She became the backbone of Safaricom’s distribution network, and it was clear that her influence was pivotal in their success.

She was one of the first dealers to become exclusive to Safaricom, which only strengthened her relationship with the company

One of the first hurdles she had was the fact that all Samchi had in cash was Sh50,000, yet they needed to buy stock and pay suppliers.

That meant they would use the money to buy stock, sell it the same day, collect and bank the cash and write cheques for suppliers the following day.

“I remember one bank manager who used to call me every morning and tell me: ‘Esther, your cheque is here, and there is no money in the account’ and I would tell her: ‘Wait. Wait. Wait. By 10 o’clock, there’ll be money in the account,’” she recalls.

Today, Samchi Group includes a diverse range of companies, from telecommunications and real estate to hospitality and agriculture. She credits Safaricom’s success to four key factors: per-second billing, going for the mass market, the prepaid approach and the provision of phones at subsidised rates.

She added that Safaricom’s branding also connected with customers. “At that point, I think it was a powerful colour and it worked for us and for them then. We made the green so strong that everywhere you saw it, you thought of Safaricom.”

Samchi Telecom now has more than 50 shops across the country. Her portfolio now includes a hotel at the heart of Nairobi, a restaurant, a real estate development company, a microfinance company and a virtual office company.

Divesting has been important for her as the dealership business is also changing as more people buy their airtime virtually and refuel their mobile wallets directly from their bank accounts.

“The reasons why the dealers will survive is because Safaricom has allowed them to participate in all the products they innovate,” she says.

“When dealers get involved in the products and services we give to the customers, there is always success.”

ROLE OF EARLY DEALERS

Safaricom chief financial services officer Esther Waititu acknowledges that pioneer dealers created an ecosystem of trust where people could come place their money.

“The role of dealers or agents in our ecosystem is really crucial. At the time when people could not understand how money was going to move around, they created an ecosystem of trust where people could come place their money,” she said.

“They would then buy float on behalf of our customers and ensure that the money was moving around.”

Waititu said the agents are their cornerstone in everything Safaricom does, in terms of ensuring customers have access and have someone they can talk to.

“It is our desire that every 2km, there is an agent who can then deal with any requirements our customer has from a cash in point of view and a cash out point of view,” she said.

“These are our key enablers and our partners.

They are embedded in our ecosystem. Without them, we would not be able to reach more than 34 million of the customers we have today.”

During the company’s regional engineering summit in Nairobi, Safaricom CEO Peter Ndegwa hailed M-Pesa’s journey.

“M-Pesa revolutionised how mobile money works and become a global benchmark for financial inclusion,” he said.

“It has had a huge impact in our society."

In Ethiopia, M-Pesa is solving the cash dependency problem.