Countries where MPESA has been expanded to

M-PESA was launched in Kenya in March 2007.

In Ethiopia, M-Pesa is solving the cash dependency problem.

In Summary

Audio By Vocalize

When the mobile payment and money transfer service M-Pesa was introduced in Kenya in 2007, nobody anticipated its transformative impact globally.

Today, the product is in more than 170 countries globally, efficiently serving more than 70 million customers.

The mobile financial services provider has grown to more than one million businesses and agents in Kenya, Ethiopia, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana and Egypt.

The service also supports more than 55,000 integrations on its Daraja platform, which hosts more than 100,000 developers.

With its current capacity of 4,000 transactions per second, the platform processes close to 100 million transactions a day, making it Africa’s largest fintech solution.

The success of this mobile money transfer and payment solution is based on its accessibility and the universal nature of the service, making it possible for millions to perform instant, secure and reliable financial transactions using their mobile phones.

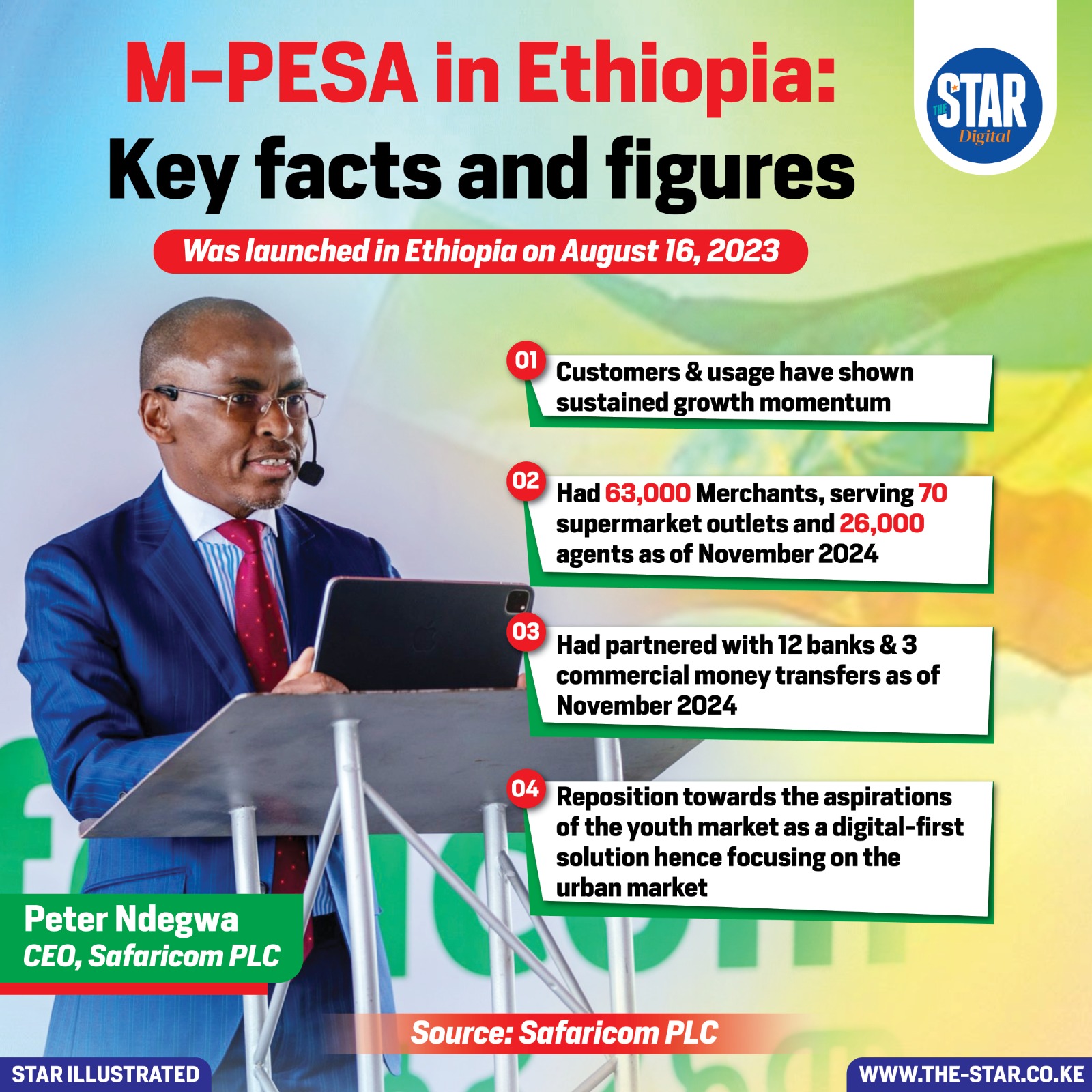

Safaricom CEO Peter Ndegwa at the recent conference in Ethiopia /HANDOUT

Safaricom CEO Peter Ndegwa at the recent conference in Ethiopia /HANDOUTOn October 6, 2022, Safaricom switched on its mobile telecommunications network and services in Addis Ababa, the country’s capital city.

This was after it was granted a nationwide full-service Unified Telecommunications Service Licence, becoming the first company in the country to launch a competitive mobile service to the state-owned Ethio Telecom.

This is part of Digital Ethiopia 2025’s plan, aimed at helping the country realise its digital potential and leverage technology to build a more prosperous society.

While the telco has taken close to 25 years to command 65 per cent of the country’s mobile phone users, as per the latest Q2, 2024 statistics from the Communications Authority, it covers 46 per cent of Ethiopia’s population, just two years after entering the market.

This means that the network has reached at least 52 million of the country’s 112 million population.

HUGE POTENTIAL

Safaricom Ethiopia CEO Vim Vanhelleputte is bullish about the network infrastructure the firm has rolled out in the country over the past year, and the prospects of success leveraging the Kenyan market.

He says the rapid market rollout and growth in overall subscribers is pegged on Ethiopia’s large population, which is also unbanked, presenting a big opportunity to scale up mobile financial services.

With more than 120.3 million citizens spread across a 1.1 million square kilometre landmass, Ethiopia is more than twice the size of Kenya, and this points to opportunities to double the eye-watering earnings reported by Safaricom in Kenya over the years.

“Three million Ethiopians turn 18 years old every year, which means every year, we are adding the equivalent of one and a half times the population of Lesotho as an addressable market in Ethiopia, so we have to be there,” Vanhelleputte said.

Safaricom Ethiopia also has the advantage of side-stepping some of the growing pains that M-Pesa reported in Kenya.

While it took the telco seven years to establish the mobile money transfer in Nairobi, the same took only seven months in Addis Ababa.

“What we are solving in Ethiopia with M-PESA is the digital payment, the cash payment to be replaced by digital payments. If you want to be successful with a new product, you need to be relevant. You need to be solving a real problem, a pain point for customers, and then you’ll become very successful,” said Safaricom Ethiopia CEO Wim Vanhelleputte.

According to the Group’s financial results unveiled in February, the number of M-Pesa customers in Safaricom’s Ethiopian subsidiary more than tripled from 3.1 million to 10.8 million in the 12 months to December 2024.

This is almost a third of the country’s mobile phone subscribers. In a recent media interview, Vanhelleputte said the quest to replicate M-Pesa’s Kenyan success in Ethiopia has to contend with completely different user dynamics.

“While it was launched to solve the money transfer problem in Kenya, it is purely a digital disruptor in Ethiopia.”

Before M-Pesa, Kenyans largely relied on Public Service Vehicles to move money, especially to rural areas, due to limited banking infrastructure.

BANKING DISRUPTION

In Ethiopia, M-Pesa is solving the cash dependency problem. “You need a network, you need people, you need distribution, you need the M-Pesa platform,’’ Vanhelleputte said.

“All these building blocks, the foundation of our success, have now been put in place. What we’re looking at now is scaling these for future success. Now we’re going to start building the house and show how successful we can be here.”

Fintech enthusiast James Maore says that just like in Kenya, M-Pesa will significantly impact the banking sector in Ethiopia by offering a convenient and accessible financial service, particularly for those without traditional bank accounts.

This will lead to increased financial inclusion and competition within the financial landscape.

“Mobile money fundamentally changed Kenya’s financial services sector, and not at the expense of the traditional banking industry,” Maore said.

“It offers customers a radically different value proposition and, despite initial strenuous objections by banks, it has enabled these banks to reach a wider market.”

In Ethiopia, it is expected to help banks cut costs and increase efficiency by moving from buildings to digital, he said.

He adds that M-Pesa is expected to revolutionise the way money is transferred and managed in Ethiopia, giving customers more control over their daily lives and saving them valuable time by digitising essential activities.

For consumers, he said, M-Pesa offers the convenience of online purchasing, discounts and rewards, referrals to new services, access to savings and loans, and the ability to carry out daily tasks on their mobile phones.

Businesses gain access to a wider market for their services, plus the efficiency of online processes with user-friendly dashboards and reports.

Last October, Safaricom extended its M-Pesa Global solution to Ethiopia to allow customers to make mobile money transactions from Kenya to Ethiopia.

The two companies aim to increase mobile money use and penetration across the region of Ethiopia, as well as boosting local economies and creating new opportunities for individuals, businesses and institutions across the country.

The expansion focuses on meeting the needs, preferences and demands of clients and users in an ever-evolving market, while prioritising the process of remaining compliant with the regulatory requirements and laws of the local industry as well.

FINANCIAL INCLUSION

It is also partnering with fintech firms as it plans to disrupt the banking sector in the landlocked country.

For instance, early this week, Safaricom M-Pesa partnered with LakiPay Financial Technologies SC (LakiPay) to enhance digital payment services in Ethiopia to enable merchants and consumers to access seamless, secure and efficient digital financial solutions.

Through this partnership, M-Pesa will integrate with LakiPay’s payment gateway, allowing merchants onboarding through LakiPay to accept payments.

This integration simplifies transactions, expands financial access and fosters Ethiopia’s growing digital economy. Safaricom M-Pesa Mobile Financial Service CEO Elsa Muzzolini welcomes this development.

“As a company that offers mobile financial services, we are committed to empowering businesses and individuals with secure and convenient digital payment solutions,’’ she said.

“This partnership with LakiPay strengthens our efforts to drive financial inclusion and digital transformation in Ethiopia by providing more options for seamless transactions.”

M-Pesa’s success is not merely a result of technological innovation but also of its alignment with the cultural practice of supporting dispersed family networks, highlighting the importance of cultural compatibility in financial technology adoption.

M-Pesa’s story is one of leapfrogging in the Global South, representing a rare full-circle success story in financial technology adoption that we can evaluate comprehensively.

At the M-PESA Africa office in Nairobi, Sitoyo Lopokoiyit heads the team that watches over the platform in the markets beyond Kenya. M-PESA Africa is a joint venture between Safaricom and Vodacom Group that was established in 2020.

Sitoyo was part of the team that tested M-PESA before it was launched in Kenya in March 2007, getting involved as his then employer, Chevron, ran the Caltex petrol stations that were among the first agents.

“The good thing is that at M-PESA Africa, we built a platform that so all the platforms are the same, all markets have the same capabilities for products and services. Now it's the market head to actually open those products and services depending on the market needs that are there,” said Sitoyo.

M-PESA was launched in Kenya in March 2007.

It has made life easier for traders and customers alike

The telco giant forecasts on having seven million AI users by 2027