On January 14, 2021, Jane* (not her real name), a primary school teacher, was heading home around 4pm when she received an unexpected M-Pesa message. It showed she had ‘received’ Sh9,000.

Before she could even open the message, her phone rang, a call from an unfamiliar number. The caller, sounding distressed, pleaded with her to return the money, claiming it had been sent by mistake.

He insisted the money was meant for a critically ill patient in hospital who needed urgent medical attention.

“The calls kept coming one after the other before I even had a chance to check my balance,” Jane recalls. When she finally opened the message, she scrolled through and confirmed that Sh9,000 had indeed been ‘deposited’.

Trusting the caller’s desperate pleas, she agreed to return the money. But, when she attempted the transaction, she received a message-her account had insufficient funds.

Moments later, the caller phoned again, now instructing her to visit the nearest M-Pesa agent, claiming the money had been ‘locked’ by Safaricom.

Worried, Jane complied and handed her phone to the agent at a nearby trading centre, as directed. What happened next was a well-executed scam. The fraudster convinced the agent to share their float number and PIN.

Within seconds, the agent’s M-Pesa balance had been wiped out of Sh19,000 and line swapped. Worse still, the fraudster took out an instant loan before switching off his phone, leaving both Jane and the agent in shock.

Unfortunately, this is not an isolated case. In a similar scam, a man recently appeared in court for conning an M-Pesa agent out of her entire float of Sh42,700.

Posing as a customer, he pretended to withdraw cash but claimed it had been sent to the wrong number. To ‘correct’ the mistake, he asked the agent to call Safaricom for a reversal.

When the alleged customer care calls went unanswered, the unsuspecting agent followed his instructions, only to realise too late that she had transferred all her money to the fraudster.

These cases are just two of the many ways scammers manipulate unsuspecting M-Pesa users, preying on trust and urgency to make quick, devastating gains.

However, with digital transactions increasingly becoming the target of fraudsters, Safaricom is also stepping up its game by redefining security and fraud prevention in the mobile money space.

USING TECH, AUTHORITIES

Through cutting-edge artificial intelligence and close collaboration with security agencies, the telco is not only preventing fraud but also ensuring customer funds remain secure.

The company says they have put in place measures that predict potential scams to swiftly respond to any fraud cases.

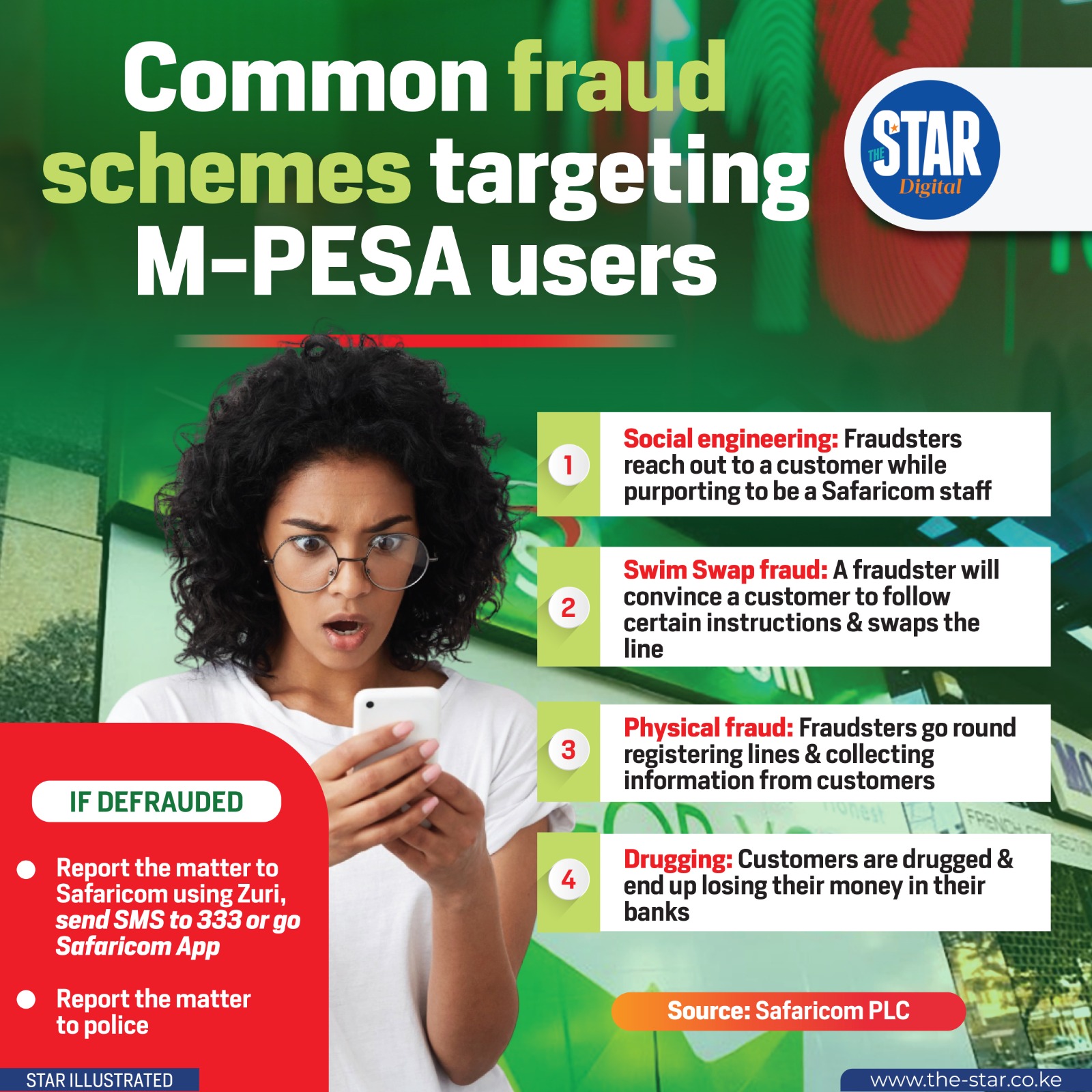

The most common fraud scheme, according to service providers, is social engineering, where a fraudster will reach out to a customer while purporting to be a Safaricom staff or convince the customer to follow certain instructions and sim swap.

Another one is physical fraud, where a customer and a fraudster masquerading as a Safaricom staff physically interact.

“Here, fraudsters impersonating Safaricom staff move around registering lines and essentially end up collecting customer information and later use it to defraud them,” says Eric Mugo, the ethics and compliance senior manager for fraud investigations at the company.

Some of the ordinary ways used by these cons to prey on their victims is through phone calls or SMS, where they impersonate Safaricom staff and people working at financial institutions.

To protect yourself from falling victim, Mugo urges customers to be extra careful and avoid answering calls from ordinary phone numbers and accepting any prompts on their phones or sharing any personal information.

“Safaricom will not call you with any number other than 0722 000 000,” Mugo says. “Even if you are called by this number, Safaricom staff will not ask for your personal information, such as M-Pesa PIN, year of birth or location.”

Customers who have been defrauded will always have their lines lose network or have a Fuliza loan despite not borrowing.

HOW CASES ARE HANDLED

Safaricom advises that should anyone suspect to have been defrauded or fall a victim, they should immediately call customer service as this enables them to trace where the money has gone to.

Customers are also urged to report the matter to the police because they are the only ones mandated by law to investigate and start the process of arresting and prosecuting the criminals behind it.

“When the police get hold of a case, they will go to the court and request for all the information from Safaricom or any other entity for that matter, to be able to investigate, and that is where we come in,” Mugo says.

Emphasising the importance of reporting such cases, the officer says through court orders, they can supply all the needed information that can help in arresting the fraudsters involved.

Apart from reaching out to Safaricom in case of such an incident, customers can also use Zuri, a virtual assistant available on social media to offer immediate support to customers in distress.

They can also use the report fraud tab on Safaricom’s App or send a message to 333, which functions on any type of phone.

The message, Safaricom says, helps us “do a good job” in tracking the money and recover where possible.

Safaricom also encourages its customers to report any cases of fraud “even if they have not been defrauded” as this information is useful in preventing the same con from swindling money from another unsuspecting customer.

“These fraudsters usually call many numbers. When they fail in one, they try the next. So the customers should report because that way, we shall be able to take subsequent actions against the numbers that they were trying to defraud,” he said.

The scammers always follow certain trends, including situations where there are promotions, hence the need to be cautious.

BANKING ON AI

Safaricom CEO Peter Ndegwa said AI is revolutionising fraud detection at M-Pesa.

“We have developed fraud detection models, ranging from identity theft to social engineering, enabling us to block and deal with fraudulent activities before they happen,” he says.

An ecosystem like Safaricom’s attracts criminals, he says, so they are using big data and AI to limit and reduce this and actually be able to pre-warn customers.

He says as criminals target digital payment platforms, big data and AI help M-Pesa predict potential fraud scenarios, including SIM swap fraud and identity theft.

Ndegwa says social engineering, which is a major fraud tactic where users unknowingly share sensitive information, is also being addressed through AI-driven security enhancements.

“Many people still use weak passwords or store them on their phones. We use AI to strengthen security and safeguard them,” Ndegwa says.

Looking ahead, the CEO says they plan to further integrate AI into their customer service and fraud prevention strategies.

By 2027, AI will handle 70 per cent of customer resolutions, ensuring faster, smarter and more secure transactions for M-Pesa users, he says. Safaricom records an access of about 18 million M-Pesa customers daily.

The company’s chief financial services officer Esther Waititu said M-Pesa works closely with security agencies to track down fraudsters and keep customer funds safe. Beyond enforcement, M-Pesa, they leverage AI to proactively detect and prevent fraud.

“One of the big models we use in AI helps identify where fraud might occur, allowing us to alert or notify customers in real time that there is a challenge with the area they are in,” Waititu says.

“So this way, we enable the customers to remain worry-free because then, you are being protected.”

This system enables M-Pesa to flag suspicious transactions, minimising the chances of fraud. She adds that M-Pesa continuously tracks transactions to enhance security.

If a customer is defrauded under certain conditions and the exact loss cannot be determined, Safaricom provides reimbursements to ensure users are not left financially stranded.

“We are dedicated to keeping our customers safe, whether through AI-driven fraud detection, security partnerships or customer compensation,” Waititu says.

Customers, she added, can also report fraudulent activity via the hotline *334# for swift action and potential reimbursement.