Senators have been briefed on how Nairobi City County Government intends to cut spending on electricity in the wake of a dispute over unpaid bills with Kenya Power.

Nairobi governor Johnson Sakaja told the Senate Standing Committee on Energy that the county is planning to harness solar power in more than 80 per cent of its facilities and establishments.

The Governor further said that use of solar energy in county buildings and street lighting will save the county government approximately Sh80 million per month.

“We also have investors who are investing in the Dandora waste site to produce energy, which will supply Nairobi County, and the surplus will be released to the national grid,” Sakaja told the Oburu Odinga-led committee.

Sakaja had appeared before the committee to shed light on the dispute between the Nairobi City County Government and Kenya Power over electricity bill.

Sakaja said that Kenya Power had issued the county with a bill amounting to sh3 billion.

He, however, noted that after physical verification of the metres, the bill dropped to Sh1.5 billion which he made a commitment to pay Sh50 million per month until the arrears are completely settled.

“Despite the county government's commitment to pay the electricity bill amounting to Sh1.5 billion, electricity supplier Kenya Power had refused to pay us Sh5.6 billion emanating from wayleave fees,” the county boss said.

The standoff between Nairobi City County Government and Kenya Power was resolved in February following a high-level meeting convened by Head of Public Service Felix Koskei.

Both sides agreed to verify outstanding claims and address them amicably.

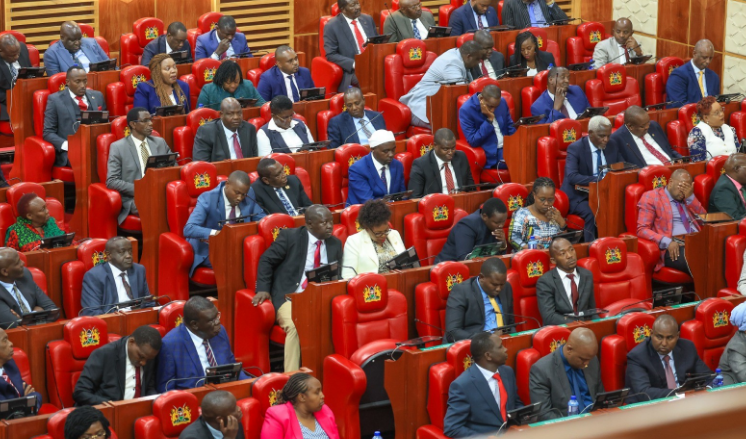

Meanwhile, the National Assembly is set to fast-track the consideration of the Excise Duty (Amendment) Bill, 2025 (National Assembly Bill No. 7 of 2025) following a directive from the Speaker Moses Wetang'ula.

In a notification issued on Tuesday, March 18, 2025, Wetang'ula announced that the Bill, which seeks to amend the Excise Duty Act to remove excise duty on imported fully assembled electric transformers, has matured for its First Reading.

A House resolution passed on February 13, 2025, allows the Speaker to refer priority Bills to relevant committees even during the short or long recess.

The Excise Duty (Amendment) Bill, 2025 (National Assembly Bill No. 7 of 2025) has been referred to the Departmental Committee on Finance and National Planning for immediate consideration.

The Leader of the Majority Kimani Ichung'wah had requested that the Bill be prioritised upon resumption of the House on April 1, 2025, a request that the Speaker granted.

If passed, the Bill is expected to enhance investment in the power sector by lowering costs associated with importing electric transformers, a critical component for electricity distribution.

The National Assembly will also prioritise the Value Added Tax (Amendment) Bill, 2025, following a directive from the Speaker.

The Bill seeks to amend the Value Added Tax Act, Cap. 476, to remove ambiguity in the commencement of exemptions granted before January 1, 2024, on capital goods for the promotion of investment in the manufacturing sector,r whose value is not less than Sh2 billion.

The House Business Committee will accelerate consideration of the Bill upon resumption. The Clerk of the National Assembly Samuel Njoroge, has been directed to notify all MPs and facilitate the Committee’s engagements on the Bill.

If enacted, the Bill is expected to remove uncertainties in tax exemptions, fostering greater clarity for investors in Kenya’s manufacturing industry.