The National Treasury and the Commission on Revenue Allocation have differed on allocation to counties, setting the stage for a fierce debate in Parliament.

As has been the case in previous years, the Treasury and CRA have once again recommended different amounts to be allocated to the devolved governments in the next financial year.

Treasury wants counties to be given Sh405.1 billion from the current Sh387.5 billion in equitable share. However, CRA wants the figure enhanced to Sh417.4 billion.

“The commission has recommended an equitable share allocation to county governments of Sh417.4 billion for 2025-26,” CRA said.

In its proposal sent to Parliament, CRA argued that it proposed the enhanced allocation to ensure no county loses revenue following the introduction of a proposed new revenue-sharing formula.

The commission has fronted the fourth basis for sharing revenue among counties that will guide how counties share revenue from 2025-26 to 2029-30.

“In implementing the Fourth Basis, a stabilisation factor has been inbuilt in the framework to ensure no county government will get less than what they were allocated in 2024-25,” CRA stated.

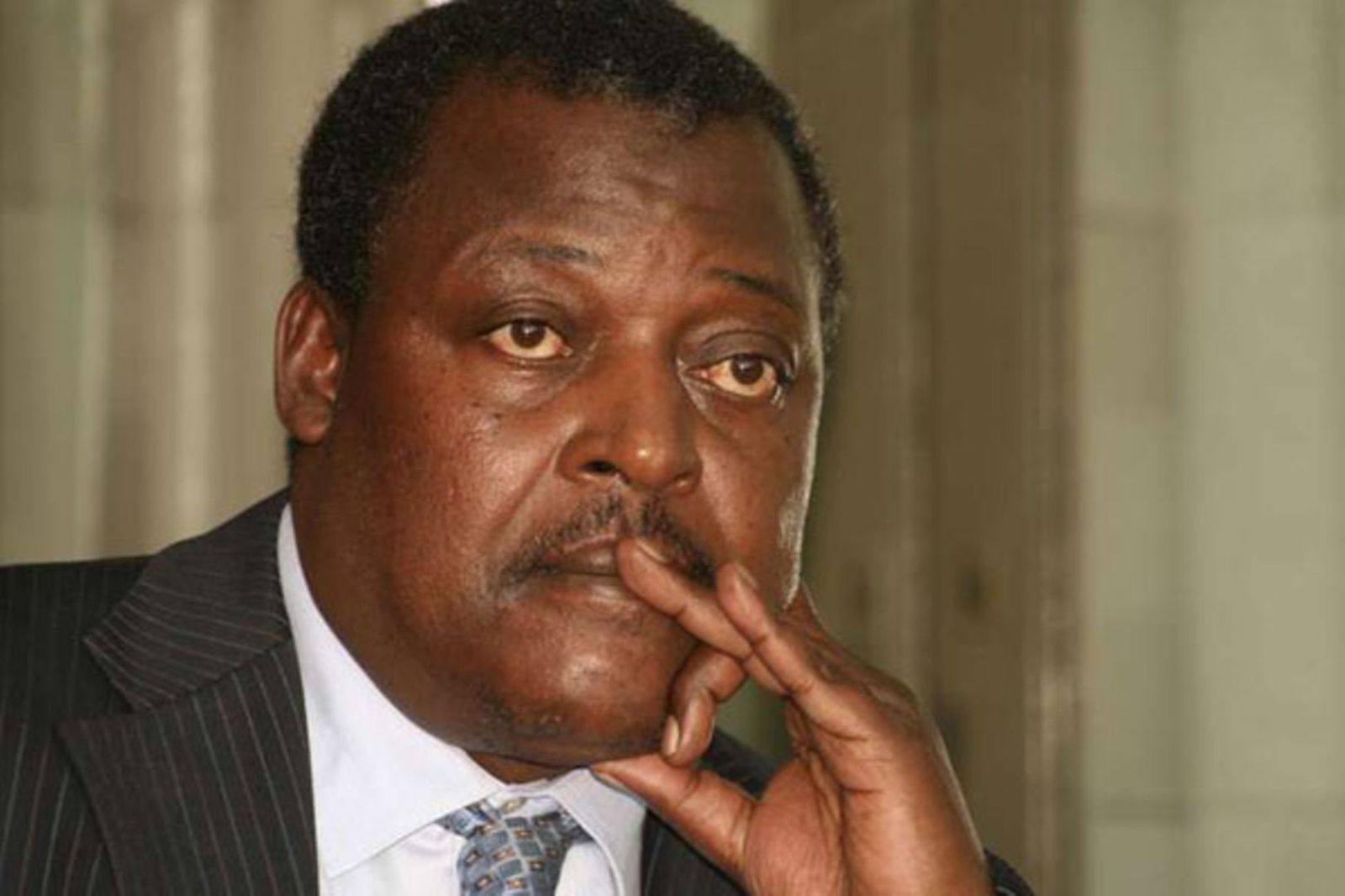

Further, Treasury CS John Mbadi wants the counties to get an additional allocation of Sh12 billion – including Sh10.5 billion to be channelled towards the Equalisation Fund.

The Equalisation Fund is used to finance development programmes that aim at reducing regional disparities among beneficiary counties.

Others are court fines at Sh11.5 million, doctor’s salary arrears at Sh1.7 billion and allocations for a 20 per cent share of mineral royalties.

County governments are allocated an equitable share of revenue to enable counties to have autonomy to plan, budget and implement development projects based on county priorities and account for the same.

While the National Treasury is proposing an increase of Sh17.6 billion to county governments’ equitable share, CRA has proposed an increase of Sh30 billion in 2025-26.